Cost Drivers Examples In Service Industry

- 14 Comments!

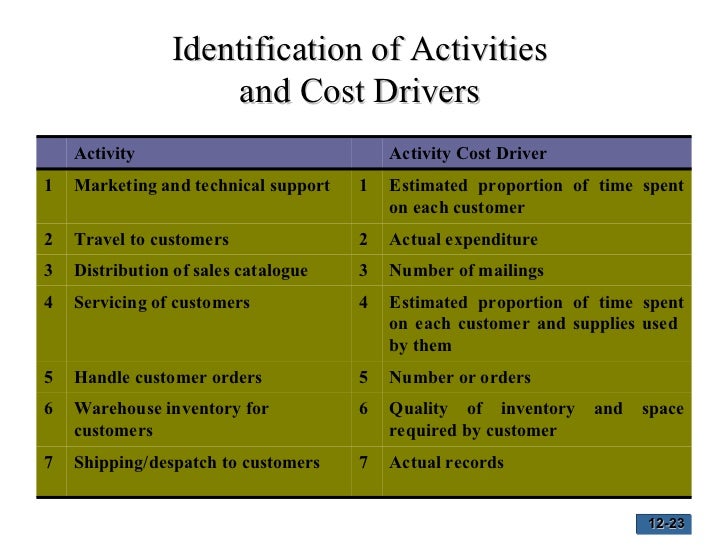

In, to identify cost drivers is very necessary for unit cost and total cost. We know that activity-based costing is based on the concept that products consume activities and activities consume resources. From activity pools, we can find cost drivers. Suppose, a company wants to produce several products. At that time, what will company do for calculating per unit cost? Just adding of raw material and labor cost and absorbing production overheads on direct labour hours or machine hours is not good way.

Jump to Eliminating the Cost Driver – A Real Life Example - In this case, the cost driver was the actual service that was provided by the company. The current accounting literature is filled with activity based costing ABC~ articles about cost drivers in manufacturing settings but very few examples of cost.

There will be many activities where we have to spent money. All these activities will become cost drivers. Examples of these cost drivers are given below: 1st: No.

Of Purchase Orders When we have to make any product, we issue the order. This is a simple activity. Its cost can be calculated one the basis of no. Of purchase orders. So, number of purchase order is an example of cost driver. Maneuver epli video game.

Of Set Up of Machine Setting up the machine is an activity of production. This activity will also consume certain expenses. To know machine set up rate, we need a cost driver. Of set up will be cost driver.

Windows 7. There is a video demonstration on Microsofts web site that will explain how this works and how to install it.

With this, we can calculate set up of machine overhead rate per set up of the machine for production. Of Machine Hours No. Of Machine hours is different cost driver which can be used for calculating machine hour rate relating to depreciation, repair and maintenance of machines. Of Parts or Weight of Material Handled Suppose, a company is making 4 products. These 4 products need 16 parts to assemble with each other.

Different expenses may be spent for this activity. We can calculate rate of this overhead on the basis of no. So, number of parts is a cost driver. Of Test or No.

Of Inspections When any product is made, it is test for checking its quality. Specific experts are appointed for this.

They consume money in the form of salary, electricity, travel and other depreciation of their specific equipments. Now, we need to calculate rate of these type of overheads. It can be calculated on the basis of no. So, number of test is cost driver.

Suppose, we need 5 test per unit of A product and suppose we have made 1000 units. It means, we need 5000 tests for these units. If the accounts of inspection and test departments show the total cost Rs. We can calculate rate of per unit test. = 1,00,000 / 5000 = Rs. 20 per unit test 6th: No.